Steps During Each Cost Volume Profit Analysis Review

5.two Cost Estimation Methods

Learning Objective

- Estimate costs using account analysis, the high-low method, the scattergraph method, and regression analysis.

Question: Recall the chat that Eric (CFO) and Susan (cost accountant) had about Bikes Unlimited's upkeep for the next month, which is August. The visitor expects to increase sales past 10 to 20 percent, and Susan has been asked to estimate profit for August given this expected increment. Although examples of variable and fixed costs were provided in the previous sections, companies typically exercise not know exactly how much of their costs are fixed and how much are variable. (Financial accounting systems do non usually sort costs as stock-still or variable.) Thus organizations must estimate their fixed and variable costs. What methods exercise organizations utilize to approximate fixed and variable costs?

Respond: Four common approaches are used to gauge fixed and variable costs:

- Business relationship analysis

- High-low method

- Scattergraph method

- Regression analysis

All iv methods are described next. The goal of each toll estimation method is to estimate fixed and variable costs and to describe this estimate in the course of Y = f + vX. That is, Total mixed cost = Total stock-still price + (Unit variable cost × Number of units). Note that the estimates presented side by side for Bikes Unlimited may differ from the dollar amounts used previously, which were for illustrative purposes only.

Account Analysis

Question: The account analysisA method of price analysis that requires a review of accounts past an experienced employee or group of employees to determine whether the costs in each account are stock-still or variable. arroyo is perhaps the nearly common starting betoken for estimating stock-still and variable costs. How is the account analysis arroyo used to guess fixed and variable costs?

Answer: This arroyo requires that an experienced employee or group of employees review the appropriate accounts and determine whether the costs in each account are fixed or variable. Totaling all costs identified as fixed provides the estimate of full stock-still costs. To determine the variable toll per unit, all costs identified as variable are totaled and divided by the measure of activeness (units produced is the measure of activeness for Bikes Unlimited).

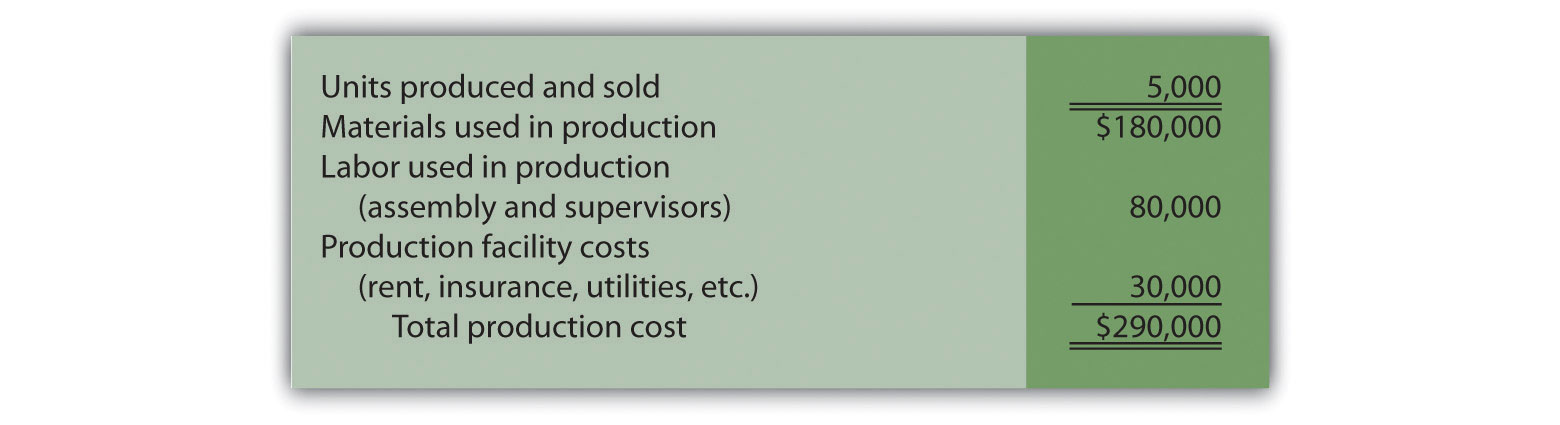

Allow'due south look at the account analysis approach using Bikes Unlimited as an example. Susan (the toll accountant) asked the financial accounting department to provide cost information for the production section for the month of June (July data is not yet available). Because the financial accounting department tracks information past department, it is able to produce this information. The product department information for June is equally follows:

Susan reviewed this cost information with the product manager, Indira Bingham, who has worked as production manager at Bikes Unlimited for several years. After conscientious review, Indira and Susan came upwards with the post-obit breakdown of variable and stock-still costs for June:

Full fixed cost is estimated to be $xxx,000, and variable cost per unit is estimated to be $52 (= $260,000 ÷ five,000 units produced). Call up, the goal is to describe the mixed costs in the equation form Y = f + vX. Thus the mixed price equation used to estimate future product costs is

Y = $30,000 + $52X

At present Susan tin approximate monthly production costs (Y) if she knows how many units Bikes Unlimited plans to produce (Ten). For instance, if Bikes Unlimited plans to produce 6,000 units for a particular month (a 20 percent increment over June) and this level of activity is within the relevant range, full product costs should be approximately $342,000 [= $30,000 + ($52 × 6,000 units)].

Question: Why should Susan exist careful using historical data for i month (June) to estimate future costs?

Answer: June may not be a typical month for Bikes Unlimited. For example, utility costs may exist low relative to those in the winter months, and production costs may be relatively high as the visitor prepares for increased need in July and August. This might outcome in a lower materials cost per unit of measurement from quantity discounts offered by suppliers. To smoothen out these fluctuations, companies often use data from the by quarter or past year to estimate costs.

Review Problem five.2

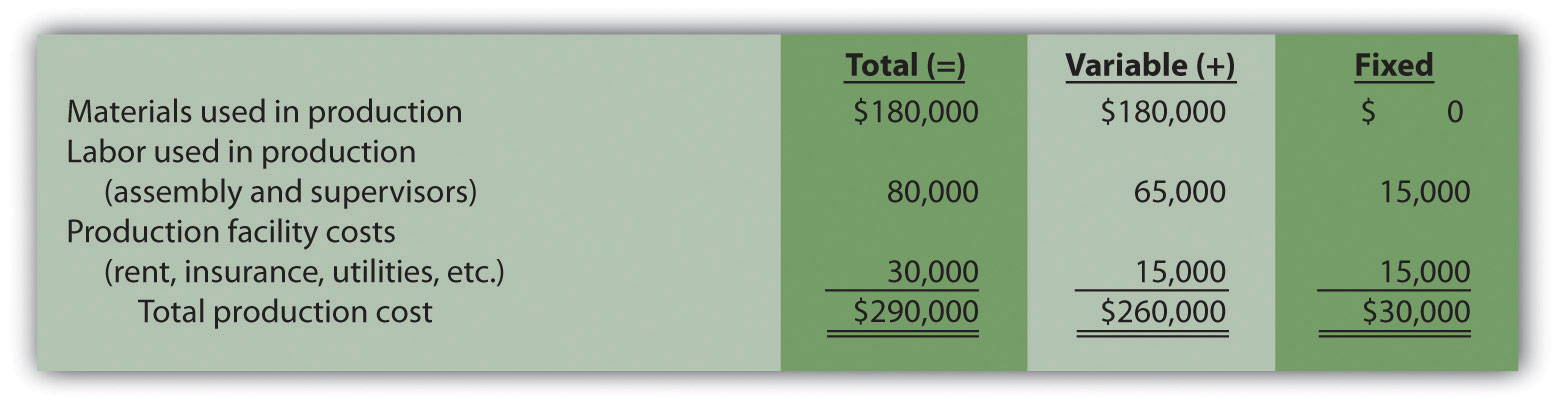

Alta Production, Inc., is using the account analysis approach to identify the behavior of production costs for a month in which it produced 350 units. The product manager was asked to review these costs and provide her best approximate equally to how they should be categorized. She responded with the following information:

- Describe the production costs in the equation class Y = f + fiveX.

- Assume Alta intends to produce 400 units next month. Calculate total production costs for the calendar month.

Solution to Review Trouble 5.2

- Because f represents total fixed costs, and five represents variable toll per unit of measurement, the cost equation is: Y = $vii,000 + $1,428.57X. (Variable cost per unit of $1,428.57 = $500,000 ÷ 350 units.)

-

Using the previous equation, just substitute 400 units for X, equally follows:

Thus total production costs are expected to be $578,428 for next month.

High-Depression Method

Question: Another approach to identifying fixed and variable costs for cost estimation purposes is the loftier-low methodA method of cost analysis that uses the loftier and depression activity information points to estimate stock-still and variable costs. . Accountants who apply this approach are looking for a quick and easy way to estimate costs, and volition follow up their assay with other more accurate techniques. How is the loftier-low method used to estimate fixed and variable costs?

Answer: The high-low method uses historical data from several reporting periods to estimate costs. Assume Susan Wesley obtains monthly product cost information from the financial accounting department for the last 12 months. This data appears in Table 5.4 "Monthly Product Costs for Bikes Unlimited".

Table 5.four Monthly Production Costs for Bikes Unlimited

| Reporting Menstruum (Month) | Total Production Costs | Level of Activity (Units Produced) |

|---|---|---|

| July | $230,000 | three,500 |

| Baronial | 250,000 | 3,750 |

| September | 260,000 | iii,800 |

| October | 220,000 | 3,400 |

| November | 340,000 | v,800 |

| December | 330,000 | 5,500 |

| January | 200,000 | 2,900 |

| Feb | 210,000 | iii,300 |

| March | 240,000 | 3,600 |

| April | 380,000 | v,900 |

| May | 350,000 | 5,600 |

| June | 290,000 | 5,000 |

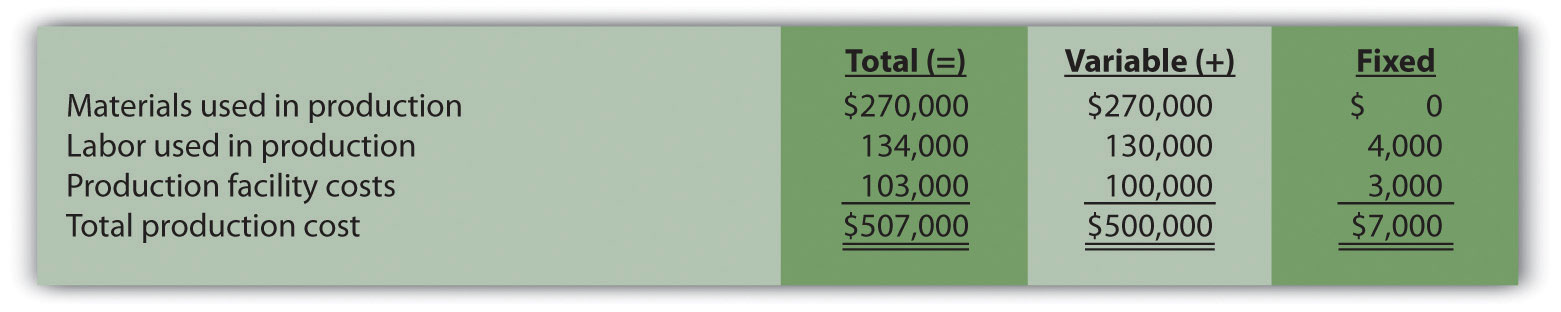

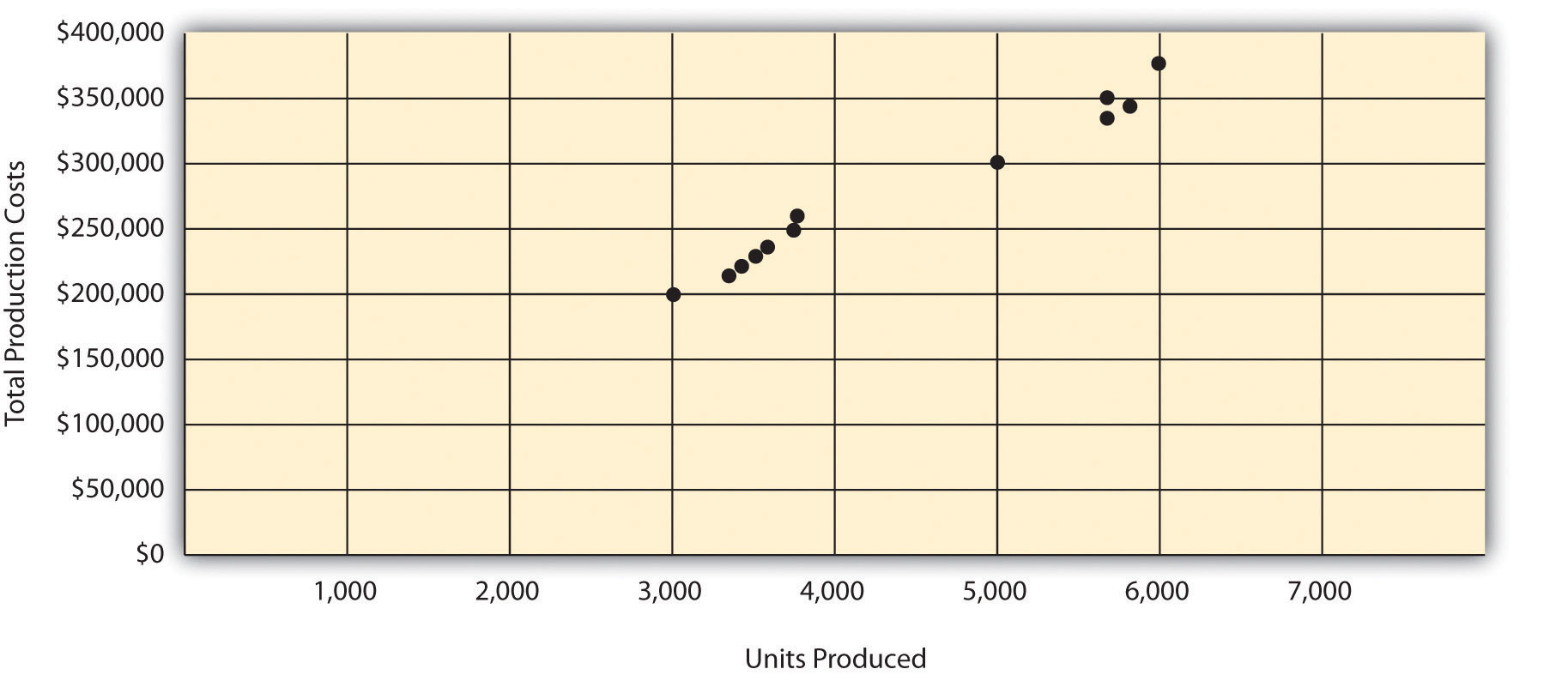

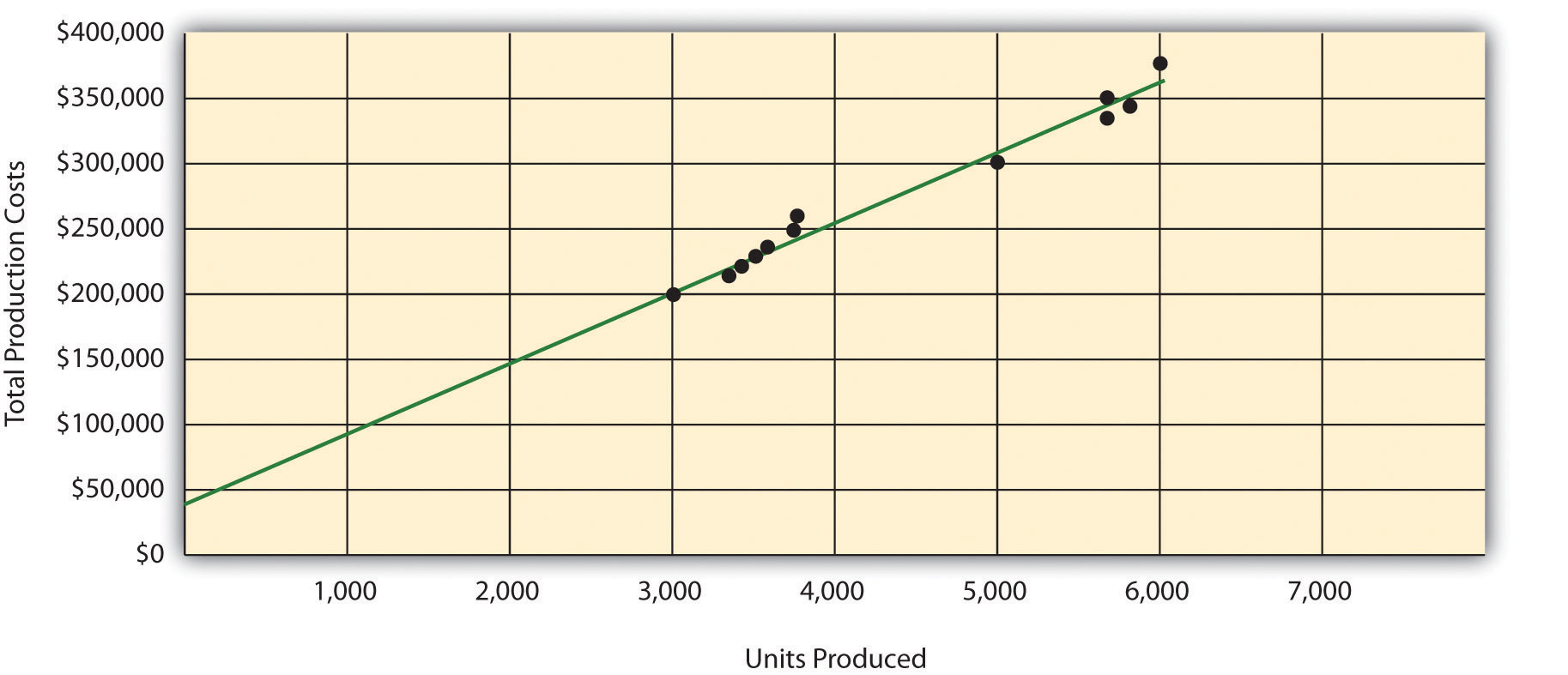

All of the data points from Table 5.iv "Monthly Production Costs for Bikes Unlimited" are plotted on the graph shown in Effigy five.four "Estimated Total Mixed Production Costs for Bikes Unlimited: High-Low Method". Although a graph is not required using the high-low method, information technology is a helpful visual tool. Susan then draws a straight line using the high (April) and low (Jan) activity levels from these data. The goal of the high-low method is to draw this line mathematically in the grade of an equation stated as Y = f + vX, which requires calculating both the total fixed costs amount (f) and per unit variable toll amount (v). Four steps are required to achieve this using the high-depression method:

Pace ane. Place the high and low action levels from the information set.

Step 2. Calculate the variable cost per unit ( v ).

Pace 3. Summate the total fixed cost ( f ).

Step 4. Land the results in equation form Y = f + 5 X.

Figure 5.4 Estimated Total Mixed Product Costs for Bikes Unlimited: Loftier-Low Method

Question: How are the four steps of the high-low method used to approximate full fixed costs and per unit of measurement variable cost?

Answer: Each of the iv steps is described next.

Step 1. Place the high and low activity levels from the information set.

The highest level of activeness (level of production) occurred in the calendar month of April (five,900 units; $380,000 product costs), and the everyman level of activeness occurred in the month of January (2,900 units; $200,000 production costs). Annotation that we are identifying the high and depression activity levels rather than the loftier and low dollar levels—choosing the high and low dollar levels can result in incorrect high and low points.

Step 2. Calculate the variable cost per unit ( v ).

Because the slope of the line shown in Figure 5.four "Estimated Total Mixed Production Costs for Bikes Unlimited: High-Low Method" represents the variable cost per unit, the goal here is to summate the gradient of the line using the high and depression points identified in step 1 (the slope adding is oftentimes referred to as "rise over run" in math courses). The calculation of the variable cost per unit of measurement for Bikes Unlimited is shown equally follows:

Step three. Calculate the total fixed cost ( f ).

After completing footstep 2, the equation to describe the line is partially complete and stated as Y = f + $60X. The goal of stride iii is to calculate a value for full fixed cost (f). Simply select either the loftier or depression activity level, and make full in the data to solve for f (total fixed costs), as shown.

Using the low action level of 2,900 units and $200,000,

Thus total fixed costs total $26,000. (Try this using the loftier activity level of 5,900 units and $380,000. You lot will get the same outcome as long as the per unit variable price is not rounded.)

Stride 4. Land the results in equation form Y = f + v X.

We know from stride 2 that the variable cost per unit of measurement is $sixty, and from step 3 that total fixed cost is $26,000. Thus we tin can state the equation used to guess total costs every bit

Y = $26,000 + $60X

Now it is possible to gauge total production costs given a certain level of production (10). For example, if Bikes Unlimited expects to produce 6,000 units during August, full production costs are estimated to be $386,000:

Question: Although the high-low method is relatively simple, information technology does have a potentially significant weakness. What is the potential weakness in using the high-depression method?

Answer: In reviewing Figure 5.4 "Estimated Total Mixed Production Costs for Bikes Unlimited: High-Low Method", yous will detect that this arroyo just considers the high and depression activity levels in establishing an estimate of fixed and variable costs. The high and depression data points may non represent the information set equally a whole, and using these points tin can effect in distorted estimates.

For instance, the $380,000 in product costs incurred in April may be higher than normal considering several production machines bankrupt down resulting in costly repairs. Or peradventure several central employees left the company, resulting in higher than normal labor costs for the calendar month because the remaining employees were paid overtime. Price accountants will ofttimes throw out the loftier and low points for this reason and employ the next highest and everyman points to perform this analysis. While the high-low method is most often used as a quick and easy way to guess fixed and variable costs, other more sophisticated methods are well-nigh oftentimes used to refine the estimates developed from the loftier-low method.

Review Problem 5.3

Alta Production, Inc., reported the following production costs for the 12 months January through Dec. (This is the same company featured in Annotation 5.xv "Review Problem 5.2".)

| Reporting Period (Month) | Total Product Costs | Level of Action (Units Produced) |

| January | $460,000 | 300 |

| February | 300,000 | 220 |

| March | 480,000 | 330 |

| April | 550,000 | 390 |

| May | 570,000 | 410 |

| June | 310,000 | 240 |

| July | 440,000 | 290 |

| August | 455,000 | 320 |

| September | 530,000 | 380 |

| October | 250,000 | 150 |

| November | 700,000 | 450 |

| December | 490,000 | 350 |

- Using this information, perform the 4 steps of the high-low method to approximate costs and state your results in cost equation form Y = f + vX.

- Assume Alta Production, Inc., will produce 400 units side by side month. Calculate total product costs for the month.

- What is the potential weakness in using this approach to judge costs?

Solution to Review Problem 5.3

-

The four steps are every bit follows:

Stride ane. Identify the high and low activity levels from the data ready.

The highest level of activity occurred in Nov (450 units; $700,000 production costs), and the lowest level of activity occurred in October (150 units; $250,000 production costs).

Step two. Summate the variable toll per unit ( 5 ).

Pace 3. Summate the total stock-still price ( f ).

After completing step 2, the equation to describe the line is partially complete and stated equally Y = f + $1,500X. To calculate total fixed costs, just select either the high or low action level, and fill in the data to solve for f (total fixed costs), as shown.

Using the high activity level,

Thus full fixed cost is $25,000.

Step 4. Country the results in equation class Y = f + v Ten.

We know from step ii that the variable cost per unit is $1,500, and from step 3 that total fixed costs are $25,000. Thus the equation used to gauge total production costs is

-

Using the equation from part i, simply substitute 400 units for X, as follows:

Thus full product costs are expected to be $625,000 for side by side calendar month.

- This arroyo only considers the high and low activity levels in establishing an estimate of fixed and variable costs. The loftier and low information points may non stand for the information gear up as a whole, and using these points tin can result in distorted estimates. In reviewing the gear up of information points for January through December, it appears that October and Nov are relatively extreme points when compared to the other 10 months. Considering the cost equation is based solely on these 2 points, the resulting approximate of production costs for 400 units of production (in part 2) may not be accurate.

Scattergraph Method

Question: Many organizations prefer to apply the scattergraph methodA method of price analysis that uses a prepare of data points to estimate fixed and variable costs. to estimate costs. Accountants who use this arroyo are looking for an approach that does not only utilize the highest and lowest data points. How is the scattergraph method used to guess fixed and variable costs?

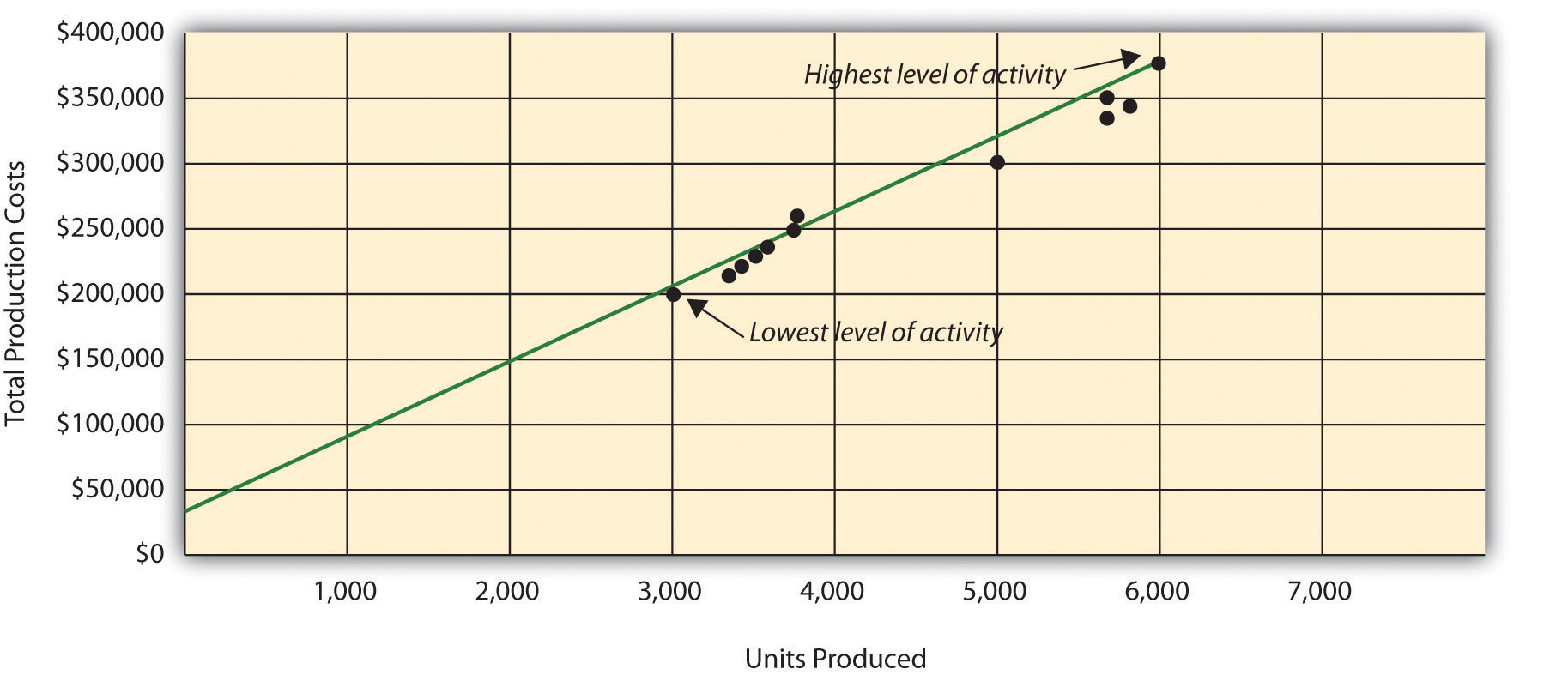

Answer: The scattergraph method considers all data points, not just the highest and everyman levels of activity. Again, the goal is to develop an judge of fixed and variable costs stated in equation grade Y = f + vX. Using the aforementioned data for Bikes Unlimited shown in Table 5.4 "Monthly Production Costs for Bikes Unlimited", we will follow the five steps associated with the scattergraph method:

Step 1. Plot the data points for each period on a graph.

Step 2. Visually fit a line to the data points and be sure the line touches one data point.

Step 3. Gauge the full fixed costs ( f ).

Step 4. Calculate the variable cost per unit ( v ).

Step five. State the results in equation form Y = f + v X.

Question: How are the five steps of the scattergraph method used to estimate total fixed costs and per unit variable cost?

Answer: Each of the five steps is described next.

Step 1. Plot the information points for each flow on a graph.

This pace requires that each information bespeak be plotted on a graph. The x-axis (horizontal centrality) reflects the level of action (units produced in this example), and the y-axis (vertical centrality) reflects the total production price. Figure 5.5 "Scattergraph of Total Mixed Production Costs for Bikes Unlimited" shows a scattergraph for Bikes Unlimited using the data points for 12 months, July through June.

Effigy v.five Scattergraph of Total Mixed Production Costs for Bikes Unlimited

Stride 2. Visually fit a line to the information points and be sure the line touches i information point.

One time the data points are plotted as described in step one, describe a line through the points touching one data point and extending to the y-axis. The goal here is to minimize the distance from the data points to the line (i.e., to make the line as close to the data points as possible). Figure v.6 "Estimated Total Mixed Production Costs for Bikes Unlimited: Scattergraph Method" shows the line through the information points. Notice that the line hits the data betoken for July (3,500 units produced and $230,000 total cost).

Figure 5.6 Estimated Total Mixed Production Costs for Bikes Unlimited: Scattergraph Method

Step 3. Approximate the total fixed costs ( f ).

The total fixed costs are simply the indicate at which the line fatigued in step two meets the y-axis. This is often called the y-intercept. Remember, the line meets the y-centrality when the activity level (units produced in this example) is zero. Stock-still costs remain the same in total regardless of level of production, and variable costs modify in total with changes in levels of production. Since variable costs are cypher when no units are produced, the costs reflected on the graph at the y-intercept must represent total stock-still costs. The graph in Effigy 5.6 "Estimated Total Mixed Production Costs for Bikes Unlimited: Scattergraph Method" indicates full fixed costs of approximately $45,000. (Note that the y-intercept will e'er be an approximation.)

Footstep 4. Calculate the variable cost per unit of measurement ( v ).

Afterwards completing step three, the equation to describe the line is partially complete and stated every bit Y = $45,000 + 510. The goal of step 4 is to summate a value for variable price per unit (v). Simply use the data point the line intersects (July: iii,500 units produced and $230,000 total cost), and fill in the information to solve for five (variable cost per unit) equally follows:

Thus variable toll per unit is $52.86.

Step five. Land the results in equation form Y = f + v Ten.

We know from stride iii that the total fixed costs are $45,000, and from footstep four that the variable cost per unit is $52.86. Thus the equation used to estimate full costs looks like this:

Y = $45,000 + $52.86X

At present information technology is possible to gauge total product costs given a certain level of production (Ten). For instance, if Bikes Unlimited expects to produce 6,000 units during August, total production costs are estimated to be $362,160:

Question: Call up that the key weakness of the loftier-low method discussed previously is that information technology considers simply two data points in estimating stock-still and variable costs. How does the scattergraph method mitigate this weakness?

Respond: The scattergraph method mitigates this weakness by considering all information points in estimating stock-still and variable costs. The scattergraph method gives united states of america an opportunity to review all data points in the information set when we plot these data points in a graph in footstep 1. If certain data points seem unusual (statistics books often call these points outliers), we can exclude them from the data set when drawing the all-time-fitting line. In fact, many organizations employ a scattergraph to identify outliers and then utilize regression analysis to estimate the cost equation Y = f + vX. We discuss regression analysis in the next section.

Although the scattergraph method tends to yield more accurate results than the high-low method, the last cost equation is still based on estimates. The line is fatigued using our best judgment and a bit of guesswork, and the resulting y-intercept (fixed cost approximate) is based on this line. This arroyo is non an exact science! However, the next approach to estimating fixed and variable costs—regression assay—uses mathematical equations to find the best-fitting line.

Review Problem 5.4

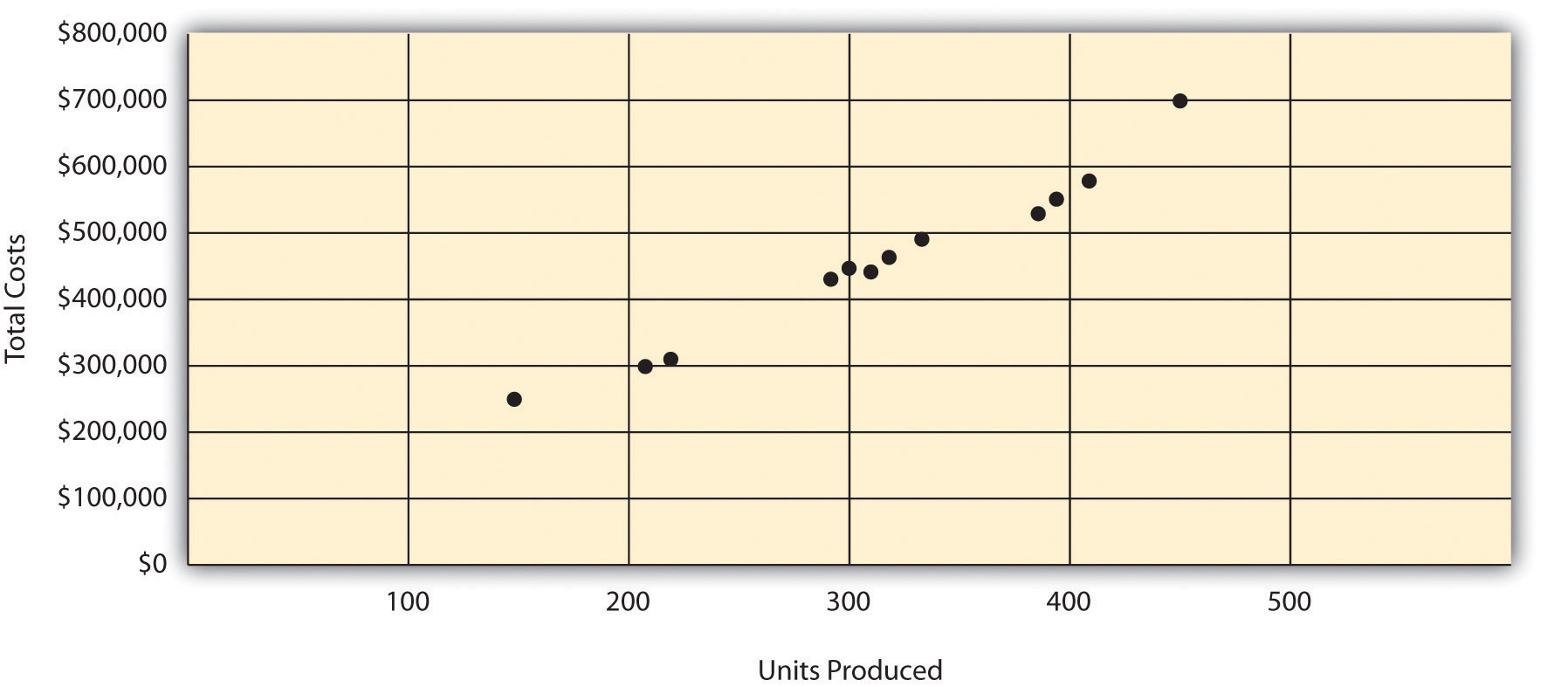

Alta Production, Inc., reported the post-obit product costs for the 12 months Jan through December. (These are the same data presented in Note v.17 "Review Trouble 5.3".)

| Reporting Menstruation (Month) | Total Production Costs | Level of Activity (Units Produced) |

| January | $460,000 | 300 |

| February | 300,000 | 220 |

| March | 480,000 | 330 |

| April | 550,000 | 390 |

| May | 570,000 | 410 |

| June | 310,000 | 240 |

| July | 440,000 | 290 |

| August | 455,000 | 320 |

| September | 530,000 | 380 |

| Oct | 250,000 | 150 |

| November | 700,000 | 450 |

| December | 490,000 | 350 |

- Using the information, perform the 5 steps of the scattergraph method to estimate costs and state your results in toll equation form Y = f + vX.

- Assume Alta Production, Inc., volition produce 400 units next month. Calculate total production costs for the month.

- When is this approach likely to yield more accurate results than the high-low method?

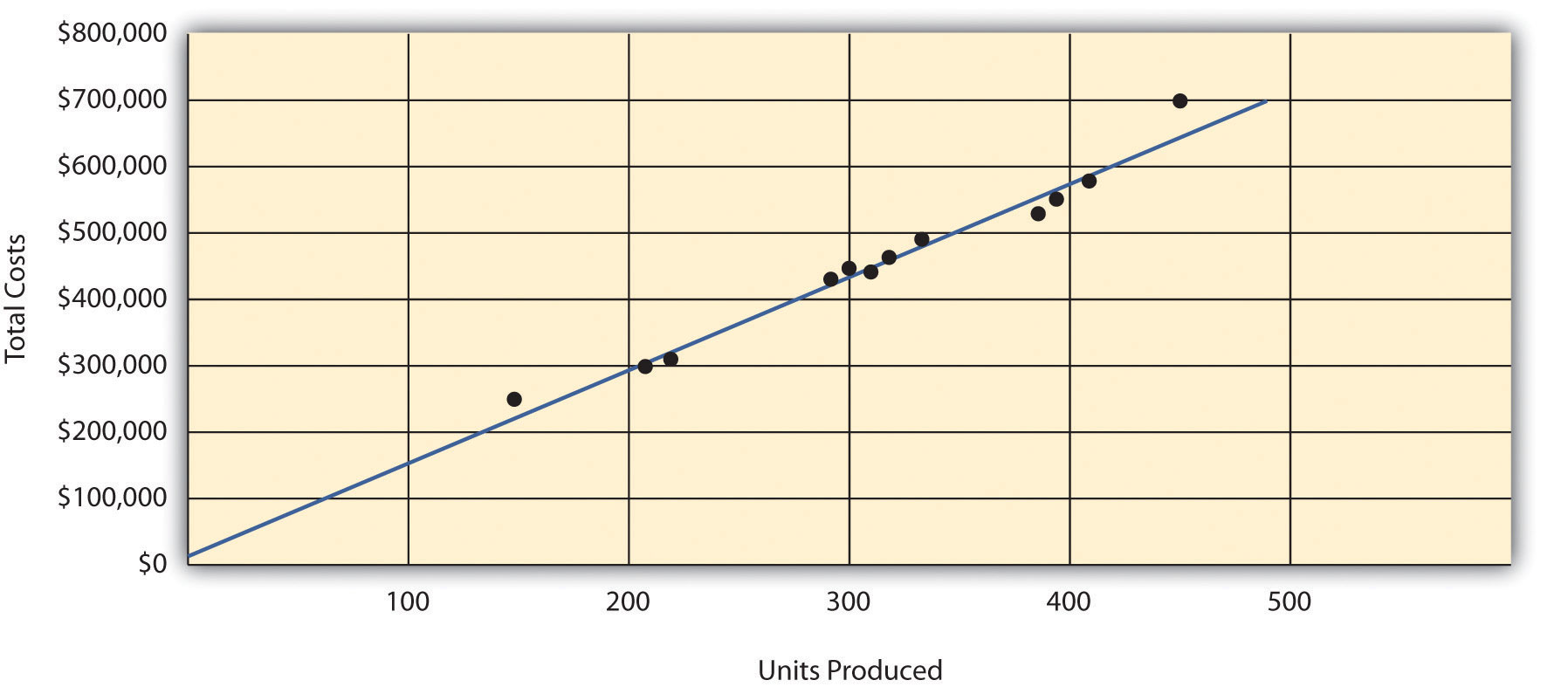

Solution to Review Problem 5.four

-

The five steps are as follows:

Step i. Plot the data points for each menstruum on a graph.

Stride 2. Visually fit a line to the data points, and be sure the line touches one data point.

Footstep iii. Gauge the total fixed costs ( f ).

The y-intercept represents total stock-still costs. This is where the line meets the y-axis. Total fixed costs in the graph appear to exist approximately $5,000. Y'all will probable get a different answer because the respond depends on the line that you visually fit to the data points. Remember y'all must draw the line through one information betoken. The line intersects the information point for March ($480,000 product costs; 330 units produced). This will exist used in step 4.

Step 4. Calculate the variable cost per unit ( 5 ).

After completing step three, the equation to depict the line is partially complete and stated equally Y = $5,000 + vX. The goal of this step is to calculate a value for variable cost per unit of measurement (v). Use the data indicate the line intersects (for March, 330 units produced and $480,000 full costs), and fill up in the data to solve for v (variable cost per unit):

Step v. State the results in equation form Y = f + 5 Ten.

Nosotros know from step 3 that the full fixed costs are $5,000, and from pace iv that variable cost per unit of measurement is $ane,439.39. Thus the equation used to estimate total production costs is stated as:

Information technology is evident from this information that this company has very piffling in stock-still costs and relatively high variable costs. This is indicative of a company that uses a high level of labor and materials (both variable costs) and a low level of machinery (typically a fixed cost through depreciation or lease costs).

-

Using the equation, but substitute 400 units for X, as follows:

Thus full production costs are expected to exist $580,756 for side by side calendar month.

- This approach is likely to yield more accurate results than the loftier-low method when the high and low points are not representative of the entire set of data. Discover that fixed costs are much lower using the scattergraph method ($five,000) than the high-low method ($25,000).

Regression Analysis

Question: Regression analysis is like to the scattergraph approach in that both fit a straight line to a ready of data points to gauge stock-still and variable costs. How does regression assay differ from the scattergraph method for estimating costs?

Answer: Regression analysisA method of toll analysis that uses a series of mathematical equations to gauge fixed and variable costs; typically washed using computer software. uses a series of mathematical equations to find the best possible fit of the line to the data points and thus tends to provide more accurate results than the scattergraph approach. Rather than running these computations past mitt, most companies use computer software, such equally Excel, to perform regression analysis. Using the information for Bikes Unlimited shown back in Tabular array 5.iv "Monthly Production Costs for Bikes Unlimited", regression analysis in Excel provides the following output. (This is a small-scale extract of the output; see the appendix to this affiliate for an explanation of how to use Excel to perform regression assay.)

| Coefficients | |

| y-intercept | 43,276 |

| x variable | 53.42 |

Thus the equation used to estimate total production costs for Bikes Unlimited looks like this:

Y = $43,276 + $53.42X

Now information technology is possible to estimate total production costs given a certain level of production (10). For example, if Bikes Unlimited expects to produce 6,000 units during August, total production costs are estimated to be $363,796:

Regression assay tends to yield the virtually authentic estimate of fixed and variable costs, assuming there are no unusual data points in the data prepare. It is important to review the data set first—perhaps in the grade of a scattergraph—to confirm that no outliers exist.

Review Problem 5.v

Alta Production, Inc., reported the following production costs for the 12 months Jan through Dec. (These are the same data that appear in Note v.17 "Review Problem 5.iii" and Note 5.nineteen "Review Problem five.four".)

| Reporting Period (Month) | Total Production Cost | Level of Activeness (Units Produced) |

| January | $460,000 | 300 |

| February | 300,000 | 220 |

| March | 480,000 | 330 |

| April | 550,000 | 390 |

| May | 570,000 | 410 |

| June | 310,000 | 240 |

| July | 440,000 | 290 |

| August | 455,000 | 320 |

| September | 530,000 | 380 |

| October | 250,000 | 150 |

| November | 700,000 | 450 |

| December | 490,000 | 350 |

Regression analysis performed using Excel resulted in the following output:

| Coefficients | |

| y-intercept | 703 |

| 10 variable | 1,442.97 |

- Using this information, create the cost equation in the form Y = f + vX.

- Presume Alta Production, Inc., will produce 400 units next month. Calculate total production costs for the month.

Solution to Review Trouble v.five

-

The toll equation using the data from regression analysis is:

-

Using the equation, simply substitute 400 units for Ten, as follows:

Thus total production costs are expected to exist $577,891 for next month.

Summary of Four Toll Estimation Methods

Question: You are now able to create the cost equation Y = f + vX to estimate costs using four approaches. What does the cost equation await like for each approach at Bikes Unlimited?

Reply: The results of these four approaches for Bikes Unlimited are summarized as follows:

- Account analysis: Y = $30,000 + $52.00X

- High-low method: Y = $26,000 + $60.00X

- Scattergraph method: Y = $45,000 + $52.86X

- Regression analysis: Y = $43,276 + $53.42X

Question: We have seen that different methods yield different results, so which method should be used?

Reply: Regression analysis tends to be most accurate because it provides a toll equation that all-time fits the line to the data points. Notwithstanding, the goal of nigh companies is to become close—the results practise not need to be perfect. Some could reasonably contend that the account analysis approach is best considering it relies on the noesis of those who are familiar with the costs involved.

At Bikes Unlimited, Eric (CFO) and Susan (cost accountant) met several days later. Subsequently consulting with her staff, Susan agreed that regression analysis was the best approach to use in estimating total production costs (keep in mind zero has been done yet with selling and administrative expenses). Account analysis was ruled out because no one on the accounting staff had been with the visitor long plenty to review the accounts and determine which costs were variable, fixed, or mixed. The high-depression method was ruled out because it only uses two information points and Eric would prefer a more accurate estimate. Susan did request that her staff prepare a scattergraph and review it for any unusual data points before performing regression analysis. Based on the scattergraph prepared, all agreed that the data was relatively uniform and no outlying data points were identified.

Susan: My staff has been working hard to decide what will happen to turn a profit if sales volume increases. Then far, we've been able to identify cost behavior patterns for production costs, and we're currently working on the cost behavior patterns for selling and administrative expenses. Eric: What do you have for production costs? Susan: The portion of production costs that are fixed—that won't change with changes in production and sales—totals $43,276. The portion of production costs that are variable—that vary with changes in production and sales—totals $53.42 per unit of measurement. Eric: When practice y'all look to have farther information for the selling and administrative costs? Susan: We should accept those results by the end of the solar day tomorrow. At that signal, I'll put together an income statement projecting profit for August. Eric: Sounds practiced. Let'south run into when you have the data fix.

Key Takeaways

- Account analysis requires that a knowledgeable employee (or group of employees) determine whether costs are fixed, variable, or mixed. If employees do non have enough experience to accurately estimate these costs, some other method should exist used.

- Table v.1 "Variable Cost Behavior for Bikes Unlimited" and Effigy five.1 "Total Variable Production Costs for Bikes Unlimited" show that full variable costs modify with changes in activeness, but per unit variable cost does not change with changes in activity. Table 5.two "Fixed Price Behavior for Bikes Unlimited" and Effigy 5.2 "Full Stock-still Product Costs for Bikes Unlimited" show that full stock-still costs do not change with changes in action, but per unit fixed costs do change with changes in activeness. Table five.three "Mixed Toll Behavior for Bikes Unlimited" and Effigy five.3 "Total Mixed Sales Bounty Costs for Bikes Unlimited" show that total mixed costs alter with changes in activity, and per unit of measurement mixed price too changes with changes in activity.

- The loftier-low method starts with the highest and everyman activeness levels and uses four steps to estimate stock-still and variable costs.

- The scattergraph method has five steps and starts with plotting all points on a graph and fitting a line through the points. This line represents costs throughout a range of activity levels and is used to estimate fixed and variable costs. The scattergraph is also used to place any outlying or unusual data points.

- Regression assay forms a mathematically determined line that best fits the information points. Software packages like Excel are available to perform regression analysis. As with the account analysis, high-depression, and scattergraph methods, this line is described in the equation form Y = f + 5X. This equation is used to approximate future costs.

- Four methods tin exist used to estimate fixed and variable costs. Each method has its advantages and disadvantages, and the pick of a method will depend on the situation at hand. Experienced employees may be able to effectively estimate fixed and variable costs by using the account analysis approach. If a quick estimate is needed, the high-depression method may be appropriate. The scattergraph method helps with identifying any unusual data points, which tin be thrown out when estimating costs. Finally, regression analysis can be run using reckoner software such as Excel and generally provides for more accurate cost estimates.

Review Problem five.6

Use the solutions yous prepared for Note 5.fifteen "Review Problem five.2", Annotation 5.17 "Review Problem 5.3", Notation v.19 "Review Problem five.four", and Note 5.21 "Review Problem v.5" to do the post-obit:

- Show the four price equations created for Alta Production, Inc., using account analysis (Annotation 5.15 "Review Problem 5.2"), the high-low method (Annotation 5.17 "Review Problem v.3"), the scattergraph method (Notation 5.19 "Review Trouble 5.4"), and regression assay (Note 5.21 "Review Problem v.5").

- Using the four equations listed in your answer to i, summate full product costs assuming Alta Production, Inc., will produce 400 units next month. Comment on your results.

Solution to Review Problem v.6

-

The price equations for each of the four methods used in Note 5.15 "Review Problem v.two", Note 5.17 "Review Problem 5.three", Note 5.19 "Review Trouble v.4", and Note 5.21 "Review Problem v.v" are shown here. Each of these cost equations was created using the aforementioned historical production cost information for Alta Product, Inc. The goal for you as a student is to understand how to develop a price equation that will help in estimating costs for the future (based on by information).

- Account analysis: Y = $7,000 + $i,428.57X

- High-low method: Y = $25,000 + $ane,500.00X

- Scattergraph method: Y = $five,000 + $i,439.39X

- Regression analysis: Y = $703 + $i,442.97X

-

Total product costs assuming 400 units volition be produced are calculated for each method given. Notation that the equations presented previously are used for these calculations.

Account assay

Loftier-low method

Scattergraph method

Regression analysis

The account assay ($578,428), scattergraph method ($580,756), and regression assay ($577,891) all yield similar estimated production costs. The high-depression method varies significantly from the other three approaches, probable because merely 2 data points are used to estimate unit of measurement variable price and full stock-still costs.

Source: https://saylordotorg.github.io/text_managerial-accounting/s09-02-cost-estimation-methods.html

0 Response to "Steps During Each Cost Volume Profit Analysis Review"

Post a Comment